Want to keep up-to-date with my blog? Subscribe here!

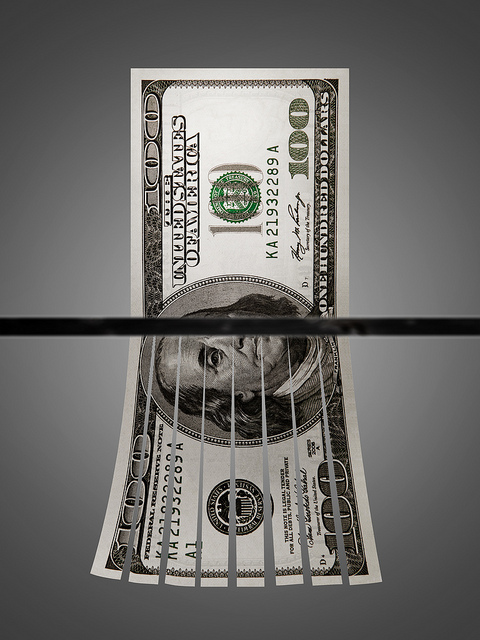

(Courtesy of Tax Credits Attribution 2.0 Generic (CC BY 2.0), https://creativecommons.org/licenses/by/2.0/legalcode)

A stranded asset is when an asset becomes prematurely useless/obsolete creating an unexpected financial loss. A Stranded asset is a concept used in finance and business. It’s becoming increasingly popular concept when discussing economics, business and climate change.

Observers often argue that the fossil fuel industry has many stranded assets because much of their infrastructure is capital- and carbon-intensive and they need a significant period period to sell their products so they can recoup the cost of the infrastructure and produce a financial return. As state on the carbon tracker website

Stranded assets are now generally accepted to be fossil fuel supply and generation resources which, at some time prior to the end of their economic life (as assumed at the investment decision point), are no longer able to earn an economic return (i.e. meet the company’s internal rate of return), as a result of changes associated with the transition to a low-carbon economy.

An example of this phenomenon is Coal – demand for coal has been significantly declining and companies have started to go bankrupt. The decline of the coal industry is being caused by multiple factors including the cheap price of cleaner natural gas and dropping cost of renewable, but also climate change concerns.

In response to Climate Change many organizations are decarbonizing; reducing their direct and indirect GHG emissions to minimize climate change. They are also reassessing their use of fossil fuels like oil and coal, increasingly scrutinizing on their carbon-heavy emissions. Organizations are reassessing fossil fuels negatively and less valuable than lower carbon emission fuels like renewable energy and natural gas. So oil and coal, traditionally value commodities, become economically stranded as the products lose demand and commands a weaker price.

The concept of stranded assets is also a useful tool in the real estate world. There is usually almost always a financial motivation behind buying property (even if there is also a lifestyle motivation). Generally, people view home ownership as a profitable financial asset and is often their largest asset.

Climate Change could potentially “strand” some homes just like the fossil fuel industry with some home owners unexpectedly losing money on their real estate investments.

So how would Climate Change “strand” properties? Let’s use a house on the coast of an ocean as an example.

One potential way is physical stranding – the property actually floods. For instance, Zillow forecasts that as many as 1 in 8 houses in Florida will be underwater by 2100.

A second way is regulatory stranding – regulations negatively impact the value of the house making it uneconomic or impossible to own. Returning to Florida, currently Real Estate agents are not responsible for disclosing flood dangers to a potential buyer. However, bills are currently in the legislature that will require real estate agents to disclose flooding risks. It’s likely that a sudden disclosure of flooding risks on a property would lower property prices and demand.

Finally, there is economic stranding – an increase in costs making the asset less profitable. Governments, like the Florida government, are facing significant increased costs in their attempt to mitigate rising sea levels. As a result, they need to increase the tax burden of their citizens including property taxes. In fact, some governments like Florida depend primarily on property taxes for their funding. Larger property taxes (as well as other taxes in general) means higher operating costs and again, lower demand for property.

Of course, the challenge is to determine when the asset will actually become stranded. It’s not always obvious.

That is the difficulty in predicting when fossil fuels will become stranded and the market will assign fossil fuel assets an uneconomic value. It’s dependent on many uncertain future developments such as the government policy, regulations, and the technological evolution of fossil fuels and alternatives such as energy storage and renewable energy.

In relation to Climate Change, there is also uncertainty about the pace and magnitude of physical change – for instance, how quickly will sea levels, by what magnitude where? There is also uncertainty about regulations – the United States have recently helped create the Paris Climate Change agreement have now stated they will quit the agreement.

As well, some houses that look like they will become “stranded” may be saved by adaptation and preparation. Cities such as Miami are also attempting to prepare for the rising sea level and may effectively mitigate the impacts. Miami may have insurmountable challenges but other cities like New York and Boston have a better chance. Will some cities be able to mitigate climate change impacts?

One commentator even reasoned that Miami’s general indifference to climate change will allow Miami to keep its taxbase healthy so it can afford to continue the expensive infrastructure upgrades to fight flooding.

In my opinion, the key factor that makes an asset finally “stranded” is when the perception of the general population shifts and they start taking into the physical, economic and regulatory liabiliites into account.

So, for example, waterfront property will start to become “stranded” when the general population decides the liabilities of waterfront (rising sea levels, more extreme weather, greater water damage, compromised aquifers, increased tax burden to protect the property etc) outweighs the benefits (recreational utility, exclusivity, scenic vistas, etc).

So, are perceptions shifting? There is evidence of increased concern about Climate Change in real estate investing.

Darob Malek-Madani and his colleagues did a risk analysis for National Real Estate Advisors and convinced them to no longer invest in South Florida.

Will this trend continue?

That may not be an easy thing to determine, but anyone who owns real estate wants to be positioned properly before that perception changes and they possibly find themselves with a stranded asset.

One thought on “Is Your Home a Stranded Asset?”